Financial Planning & Analysis (FP&A)

Subject: Enterprise Software Integration and Deployment

Case Study by Thomas Kingsley

Financial Planning & Analysis (FP&A) is the process of compiling and analyzing an organization's long-term financial strategy. This is a vital because the process involves strategic planning, management reporting, and decision and report controls. No matter what industry one works in, Financial Planning & Analysis (FP&A) in consort with rolling forecasts play an integral role in various capacities. In this case, financial planning and analysis played a primary role in the evaluation to replace the current practice management software.

Scenario

An organization is considering replacing its existing practice management software with a different enterprise solution. Unlike typical vendors who charge straightforward fees, such as per license or user, the proposed vendor charges a percentage fee based on the organization's annual revenue—in this case, 8%. The vendor claims that their business model will streamline the billing process and reduce costs by eliminating the need for an internal billing department. According to the vendor’s proposal, this will lead to higher revenue for the organization, as it will no longer need to staff a billing department or cover related benefits. Additionally, the company will save on employee training costs as it grows, and the all-inclusive software contract covers support and upgrades.

On the other hand, the organization is currently locked into a 12-year contract with its existing software vendor, with 11 years remaining and ongoing associated fees. The company invested several months researching enterprise software solutions to ensure they made the right choice with the current vendor. They also spent two months negotiating contract details, including data migration, employee training, and upgrading the network—all of which incurred additional costs beyond the software itself. The entire process from inquiry to go-live took 8 months, including network upgrades, training, and data migration.

This case study will focus solely on the financial comparison between the current software and the proposed vendor’s solution, analyzing how the decision will impact the organization’s bottom line. All other factors, such as research, training, hardware upgrades, and data migration, will be excluded from this analysis.

Financial Planning & Analysis (FP&A)

The analysis started with a thorough review of the proposed vendor contract, which outlined an 8% fee based on the organization’s total annual revenue. However, several other factors need to be considered, including outstanding fees from the current contract, projected payroll expenses, and overall organizational revenue. To assess the financial impact, Thomas undertook the following research:

- Determine the average annual revenue growth percentage the organization generated for the previous 11 years.

- The average annual revenue growth is 6%.

- Forecast company revenue for 11 years using the average revenue percentage.

- Determine the average annual billing department payroll percentage increase for the previous 11 years.

- The average annual billing department payroll increase is 3.7%.

- Forecast billing department payroll for 11 years using the average payroll percentage./li>

- Determine the contractual financial obligation to the current software vendor.

- The total financial obligation is $1,134,847.

- The monthly line item expense is $103,168.

- Forecast the new vendor fee using the proposed 8%.

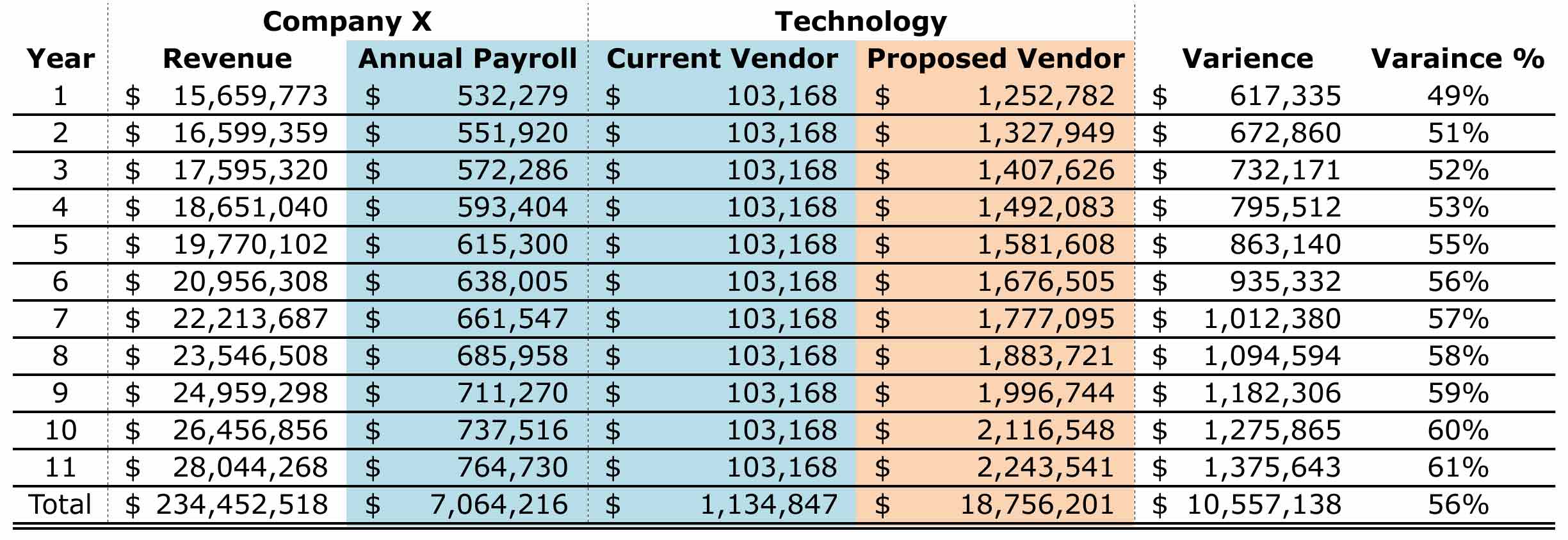

The table below compares the costs of outsourcing a business unit versus managing it internally, highlighting the financial impact of signing a new contract with the proposed vendor on the organization’s bottom line.

The data in the table reflects a projected 6% year-over-year revenue growth and a 3.7% annual increase in payroll expenses. It also outlines the vendor’s projected costs based on the proposed 8% fee. Additionally, the table includes the organization’s current vendor contract, which requires a monthly payment of $103,138, totaling $1,134,847 for the remaining duration of the agreement.

If Company X retains its fully staffed internal billing department and continues using the existing software, year one expenses will amount to $532,279 in payroll costs and $103,168 in current vendor expenses, totaling $635,447. However, if the company signs a new contract with the proposed 8% fee, first-year expenses will rise to $1,252,782. This represents an additional $617,335 in costs to outsource the billing department and switch to the new software, compared to maintaining the internal billing department and current software. In other words, Company X will experience a 49% increase in operating expenses in year one. Over the remaining 11 years of the contract, the company will incur an additional $10,557,138 in operating expenses, equating to a 56% overall increase in costs over the duration of the contract.

Conclusion

Thomas was brought in a few months after the original contract was signed and work had already commenced to expedite the project. Upon reviewing both the project and contract, he identified several key details that had been overlooked by the organization prior to signing. He brought these issues to light for future consideration.

- Thoroughly reviewing every detail of a contract before signing is essential. In this case, the contract was signed without a comprehensive review, resulting in the loss of an opportunity to negotiate key terms. Notably, the contract set a 12-year term and lacked a termination clause—two critical elements that should have been addressed. While the company can move forward with the proposed vendor, it remains legally obligated to honor its financial commitments to the current vendor, as the signed contract is legally binding. This contract meets the essential criteria of a binding agreement: offer, acceptance, and consideration.

- There is no such thing as a "standard" contract. Every contract should be reviewed in detail. If the language is unclear or difficult to understand, it is crucial to consult a lawyer for clarification before signing.

Regarding the suggestion to replace the existing practice management software with a new enterprise solution, there were no issues with the current software, nor was there a compelling reason to replace it, especially considering it had only been deployed 16 months earlier. The push for change came from the new general manager, who preferred to implement practice management software he was familiar with. However, after conducting a thorough analysis, Thomas strongly recommended that the organization retain the current software.

The key lesson the company learned was that while outsourcing operations can be beneficial after thorough due diligence, making outsourcing decisions hastily—without proper research—can be risky. Such a decision could have led to millions of dollars in unforeseen costs. Financial Planning & Analysis (FP&A) plays a crucial role in helping achieve organizational goals, improving financial performance, managing risks, and controlling costs.