Accounting Statements

Subject: Income Statement, Cash Flow Statement, and Balance Sheet

Case Study by Thomas Kingsley

All organizations rely on accounting software to process financial data, but having a solid understanding of accounting fundamentals is equally important. For example, one may need to manually verify calculations to ensure accuracy and rule out data corruption that could lead to flawed reports. In this context, Thomas provides a clear explanation of the Income Statement, Cash Flow Statement, and Balance Sheet. He breaks down these financial statements in a way that makes it easy for any reader to understand how the financial information flows, demonstrating how the numbers are calculated and eliminating the guesswork involved in manually preparing accounting statements.

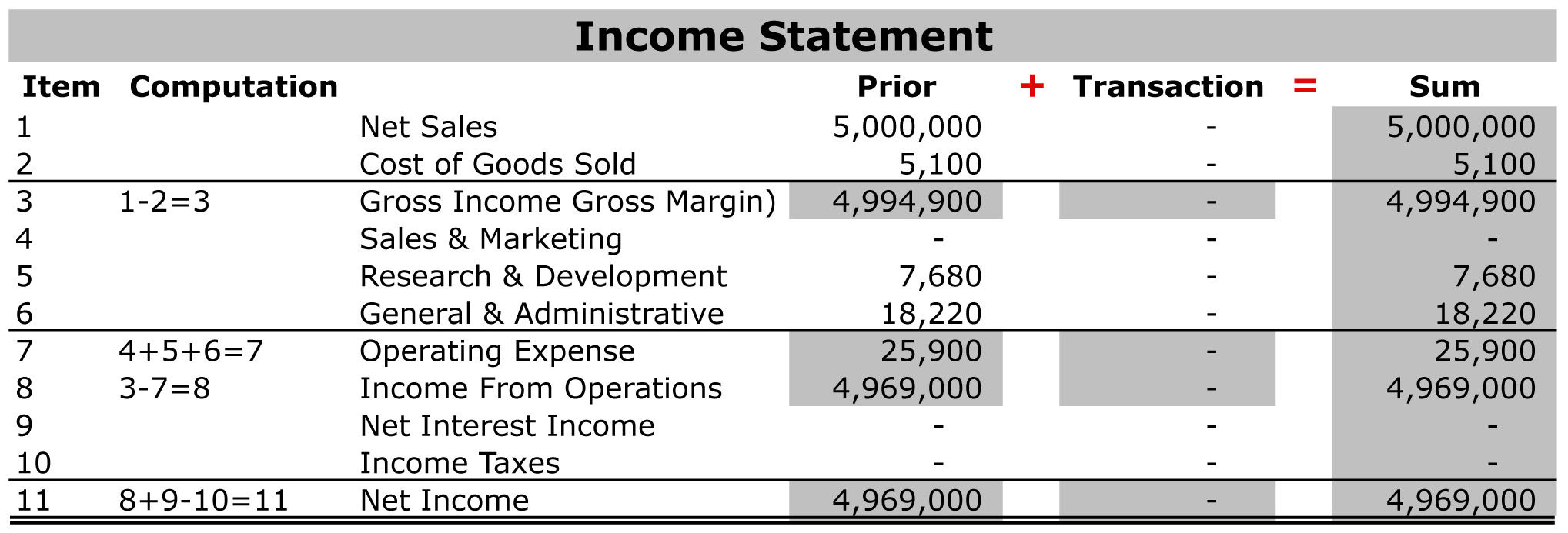

Income Statement, also known as Profit & Loss Statement, or Statement of Revenue and Expense

An income statement is a financial document that outlines a company's financial performance over a specific accounting period, typically a fiscal quarter or year. It provides a summary of how the business generates revenue and incurs expenses through both operating and non-operating activities, ultimately revealing the net profit or loss for that period.

How To Evaluate An Income Statement

If a company’s revenue surpasses its expenses, the income statement will show a net income; if expenses exceed revenue, it will report a net loss.

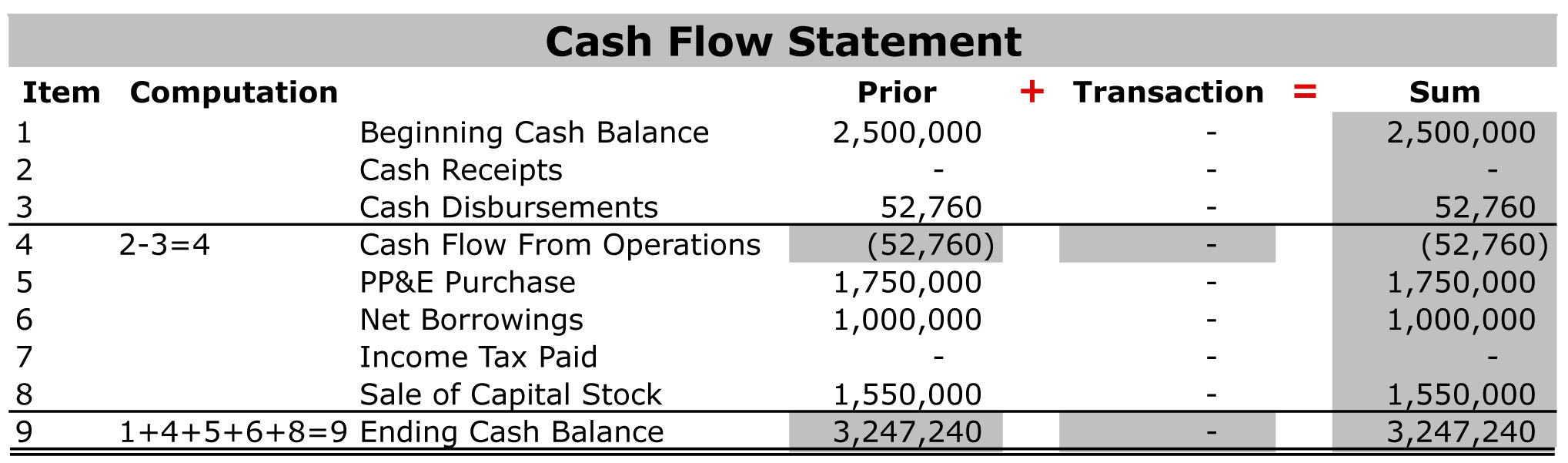

Cash Flow Statement

The cash flow statement provides a comprehensive overview of all cash inflows a company receives from its operations and external investments, as well as all cash outflows used to fund business activities and investments during a specific quarter.

How To Evaluate A Cash Flow Statement

Compare the cash generated by operating activities with the cash spent on investing activities. If operating activities do not generate enough cash, the shortfall must be covered by financing activities.

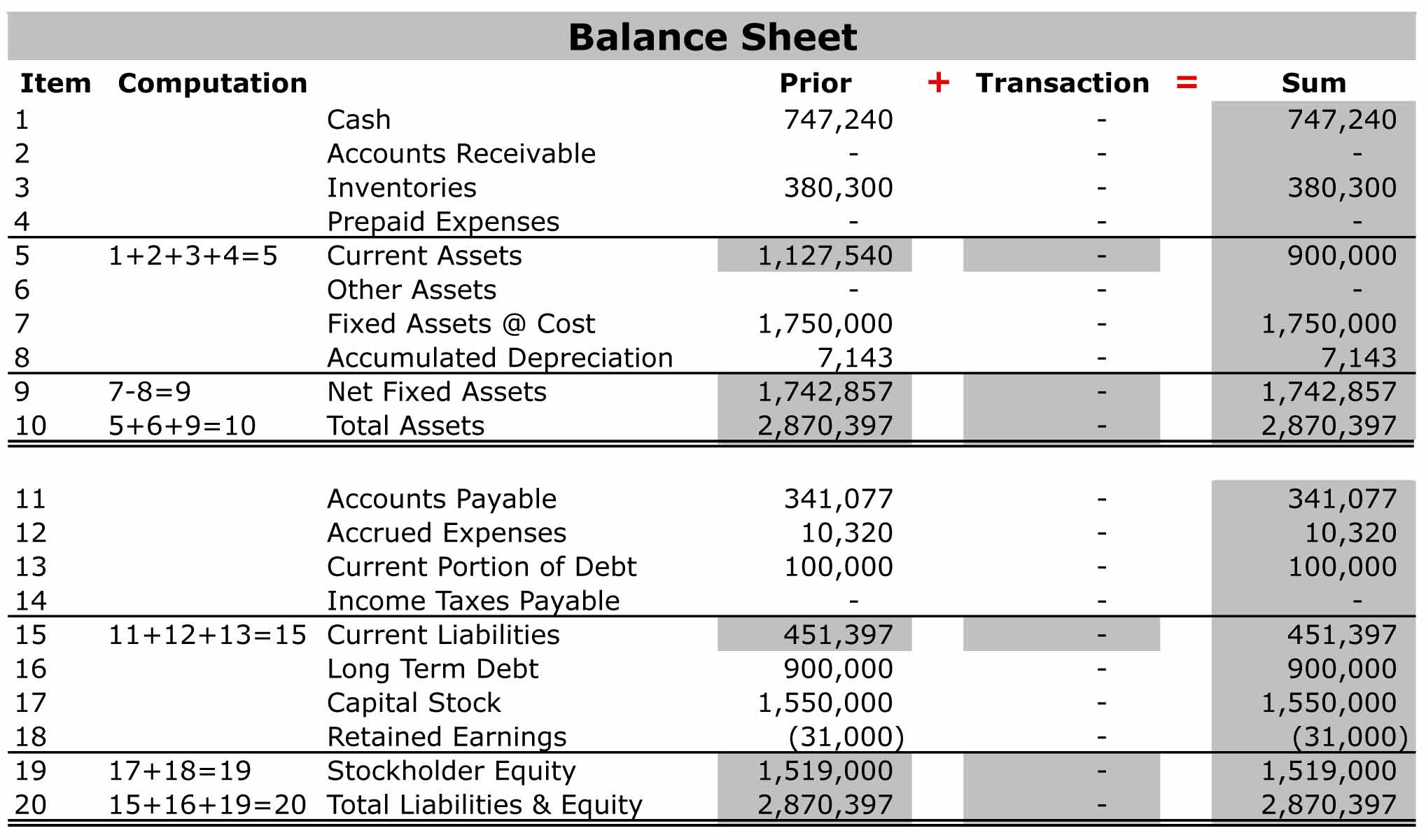

Balance Sheet

A balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time. The three sections of the balance sheet help investors understand what the company owns, what it owes, and the amount invested by shareholders.

Compare the company's debt to its stockholders' equity to assess whether it depends more on creditors or on owners for financing.

The balance sheet adheres to the basic formula: Assets = Liabilities + Shareholders' Equity